Empower Your Business: Bagley Risk Management Insights

Just How Livestock Danger Protection (LRP) Insurance Coverage Can Safeguard Your Livestock Financial Investment

Livestock Threat Protection (LRP) insurance coverage stands as a reliable guard against the uncertain nature of the market, offering a calculated strategy to safeguarding your possessions. By delving into the details of LRP insurance and its multifaceted advantages, livestock manufacturers can strengthen their financial investments with a layer of safety and security that transcends market variations.

Understanding Livestock Risk Protection (LRP) Insurance Policy

Comprehending Livestock Threat Security (LRP) Insurance is essential for animals producers aiming to alleviate financial threats connected with price variations. LRP is a federally subsidized insurance policy item made to safeguard producers versus a drop in market rates. By supplying protection for market rate decreases, LRP helps manufacturers lock in a floor rate for their livestock, making certain a minimal level of earnings regardless of market variations.

One trick element of LRP is its versatility, enabling manufacturers to personalize insurance coverage levels and policy sizes to suit their certain needs. Producers can pick the number of head, weight variety, insurance coverage rate, and coverage duration that straighten with their production goals and take the chance of resistance. Understanding these adjustable alternatives is essential for manufacturers to properly manage their price danger direct exposure.

In Addition, LRP is available for different livestock kinds, consisting of livestock, swine, and lamb, making it a versatile risk administration tool for animals manufacturers throughout different industries. Bagley Risk Management. By familiarizing themselves with the complexities of LRP, producers can make enlightened decisions to guard their investments and guarantee economic stability when faced with market uncertainties

Benefits of LRP Insurance Coverage for Animals Producers

Animals manufacturers leveraging Animals Danger Defense (LRP) Insurance policy obtain a strategic advantage in shielding their investments from price volatility and securing a stable financial footing amidst market uncertainties. One essential benefit of LRP Insurance coverage is cost security. By establishing a flooring on the cost of their animals, manufacturers can reduce the danger of considerable economic losses in case of market declines. This permits them to intend their budgets more effectively and make informed choices about their operations without the constant concern of rate changes.

Furthermore, LRP Insurance policy offers manufacturers with comfort. Knowing that their financial investments are protected versus unexpected market modifications permits producers to concentrate on various other aspects of their service, such as boosting pet health and wellness and well-being or enhancing production processes. This assurance can lead to enhanced efficiency and profitability in the long run, as producers can operate with more confidence and stability. Generally, the advantages of LRP Insurance policy for livestock producers are substantial, providing a useful device for taking care of threat and ensuring financial safety and security in an unpredictable market setting.

Exactly How LRP Insurance Coverage Mitigates Market Dangers

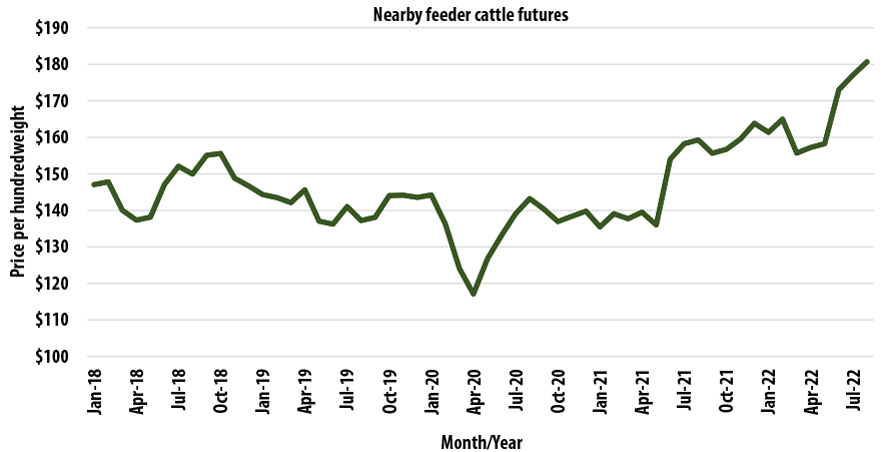

Alleviating market threats, Livestock Risk Defense (LRP) Insurance coverage offers livestock manufacturers with a dependable guard against rate volatility and economic unpredictabilities. By using security against unexpected rate decreases, LRP Insurance coverage assists producers secure their financial investments and keep monetary stability in the face of market fluctuations. This type of insurance enables livestock producers to lock in a rate for their animals at the start of the plan duration, making certain a minimal rate degree no matter market adjustments.

.png)

Actions to Secure Your Livestock Investment With LRP

In the realm of agricultural danger management, executing Livestock Risk Defense (LRP) Insurance includes a tactical procedure to safeguard financial investments versus market changes and uncertainties. To secure your livestock investment efficiently with LRP, the first step is to analyze the specific risks your procedure faces, such as price volatility or unexpected weather occasions. Next, it is crucial to research and pick a respectable insurance provider that provides LRP plans customized to your animals and business requirements.

Long-Term Financial Protection With LRP Insurance

Making sure enduring financial security through the use of Animals Risk Defense (LRP) Insurance policy is a sensible long-lasting method for farming producers. By including LRP Insurance policy into go their risk administration plans, farmers can secure their livestock financial investments against unforeseen market changes and adverse events that might endanger their economic well-being with time.

One trick advantage of LRP Insurance policy for long-lasting financial protection is the assurance it supplies. With a reputable insurance coverage in position, farmers can alleviate the economic threats connected with unstable market conditions and unexpected losses because of factors such as disease episodes or all-natural calamities - Bagley Risk Management. This stability permits producers to focus on the daily operations of their animals business without continuous fret about possible monetary troubles

Additionally, LRP Insurance policy provides an organized method to managing danger over the long-term. By establishing details insurance coverage levels and choosing proper recommendation periods, farmers can tailor visit homepage their insurance policy intends to straighten with their financial objectives and risk tolerance, making certain a sustainable and safe future for their livestock procedures. In verdict, purchasing LRP Insurance coverage is an aggressive method for agricultural producers to accomplish lasting monetary safety and protect their source of incomes.

Final Thought

Finally, Livestock Danger Protection (LRP) Insurance policy is an important tool for livestock manufacturers to alleviate market dangers and safeguard their investments. By comprehending the benefits of LRP insurance and taking steps to execute it, producers can attain long-lasting monetary protection for their operations. LRP insurance policy supplies a safeguard versus cost variations and makes sure a level of stability in an uncertain market atmosphere. It is a wise option for safeguarding livestock investments.